Advertisement

Advertisement

Tax Planning Fundamentals and Core Strategy Concepts

Build a strong foundation in tax planning principles. Understand tax brackets and filing statuses that apply to most taxpayers for better financial health.

Maximizing Tax Deductions and Smart Expense Claims

Identify and claim all eligible tax deductions effectively. Learn about standard and itemized deductions to maximize your tax savings every filing season.

Tax Credit Optimization for Maximum Benefit Returns

Leverage valuable tax credits to reduce your tax liability. Understand eligibility for education and energy credits to maximize your financial benefits.

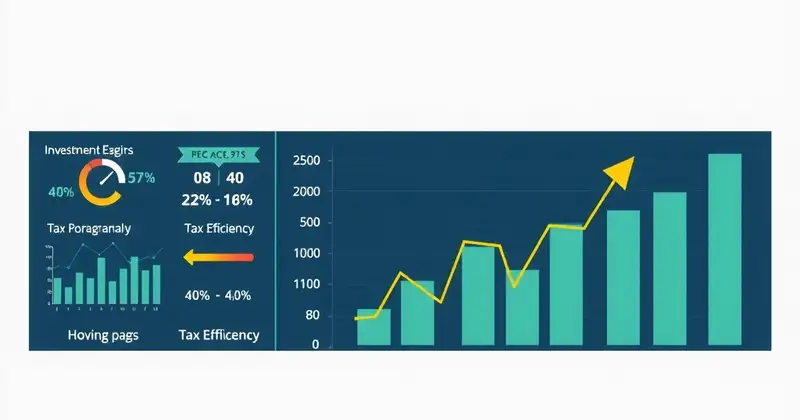

Investment Tax Planning for Efficient Wealth Growth

Optimize your investment portfolio for tax efficiency. Learn about capital gains and tax-loss harvesting to grow your wealth while minimizing tax impact.

Retirement Tax Optimization and Savings Advantages

Plan your retirement savings with tax advantages in mind. Compare 401k and IRA options to understand withdrawal strategies for a secure financial future.

Business Tax Planning Strategies for Entrepreneurs

Implement smart tax planning for your business operations. Learn about expense deductions and entity structures to optimize your business tax position.

Advertisement

Advertisement

Year-End Tax Planning Tips and Deadline Strategies

Execute effective year-end tax planning moves. Learn timing strategies and last-minute opportunities to optimize your tax position before the new year.

Tax Compliance and Audit Preparation Best Practices

Maintain proper tax compliance and prepare for potential audits. Learn documentation requirements and record-keeping best practices for total peace of mind.